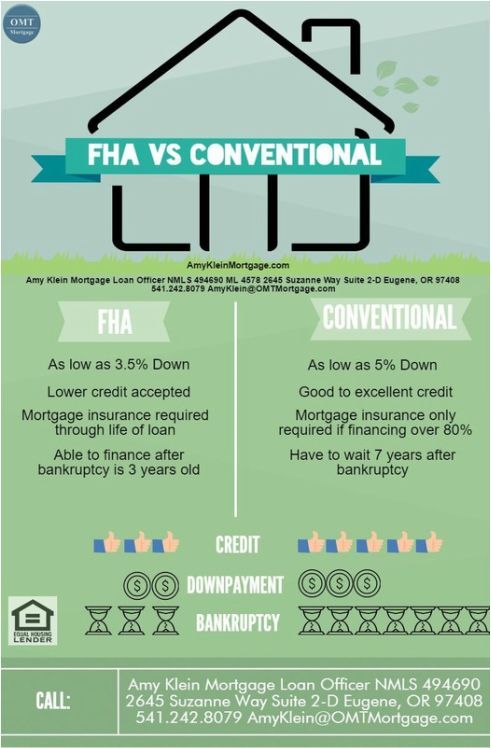

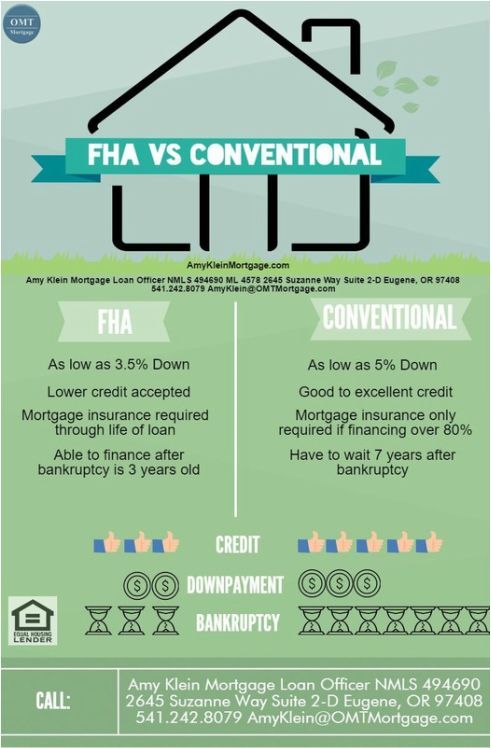

It may not always seem clear whether to apply for a FHA loan or conventional loan. Even if you are unable to secure a conventional mortgage due to credit score income debt-to-income DTI ratio or other criteria you may be able to get an FHA loan.

Fha Vs Conventional Mortgage Loans Eugene Oregon Amykleinmortgage Mortgage Payoff Tips Mortgage Payofftips Payo Mortgage Tips Mortgage Marketing Fha

You have a below-average credit score.

. Its possible to get an FHA loan with a 35 down payment and a 580 FICO score. Mortgage insurance works a little differently for FHA loans too. FHA Loan Refinance Programs.

In general it is easier to qualify for an FHA loan. FHA loans require mortgage insurance regardless of. FHA and Conventional Loans Both Offer a Great Low Down Payment Option.

FHA loans allow for higher DTI than conventional loans as high as 57 in certain cases whereas a conventional loan might be capped at a DTI of 45 to 50. However it may be lower in some cases. This is in part because a conventional loan usually requires you to put down a larger down payment generally 20 than with an FHA loan and requires a better creditworthiness picture.

Compare Lowest Mortgage Lender Rates Today in 2022. Ad Use Our Comparison Site Find Out Which Conventional Loan Lender Suits You The Best. To be eligible for a 35-percent down payment a borrower needs a credit score of at least 580.

Because FHA loans are backed by the government and Conventional loans are not the qualifications for each loan type look different. Overall a conventional loan is generally a better option if your credit scores are excellent and you can make a 20 down payment. Like their lenient credit score terms FHA loans also have more lenient DTI requirements.

Conventional loans often offer lower interest rates than FHA loans. Dont act without first reading this complete guide. FHA loans have typically been known as loans for first-time homebuyers filled with extra paperwork and complexity since its a government-insured program.

Save Time Money. Ad Top-Rated Mortgage Rates 2022. Conventional Refinance Programs.

You need to have a higher credit score lower debt-to-income DTI ratio and higher down payment to qualify for a conventional loan. It depends on your homebuying goals and financial situation. Homebuyers with high credit scores may benefit from a conventional loan because they may receive low rates and non-permanent mortgage insuranceFHA loans can be great options for borrowers who have the income to afford a home.

Generally an FHA loan is better if. Should you get a conventional or an FHA mortgage. Conventional loans are considered more competitive in a crazy housing market.

FHA loans have lower down payment requirements 35 than conventional loans typically 5 to 20. In my experience unless you have a specific reason for needing an FHA loan a conventional loan is going to be easier cheaper and better for many reasons. Generally FHA loans are easier to qualify for.

An FHA loan is a government-backed home loan insured by the Federal Housing Administration. The mortgage industry revolves around this and financial institutions do their best to minimize risk and maximize profits while staying competitive. Theres not a set DTI ratio for conventional loans as many but generally speaking youll need a DTI of 50 or less.

Apply Start Your Home Loan Today. The primary difference is risk assessment. FHA lending is more flexible in terms of credit score but requires a little bit more down.

Get Instantly Matched With Your Ideal Conventional Loan Lender. They allow for lower income lower credit scores and a higher debt-to-income ratio meaning they allow you to carry more debt relative to your income. An FHA loan has less-restrictive qualifications compared to a conventional loan which is not backed by a government agency.

Or a conventional loan with just 3 down payment and a 620 FICO score. FHA loans have lower credit score requirements as. FHA allows for a higher debt to income ratio than conventional loans 55 compared to 50 If you have a credit score higher than 700 you will be better off with a conventional loan because youll be able to remove the PMI at some point without having to refinance.

However FHA loans usually may not be used for. For instance you do not have to make it your primary residence. It may be possible to get a conventional loan with a lower credit score but the borrower will likely have to pay a higher interest rate.

Ad Were Americas 1 Online Lender. The maximum DTI for FHA loans is 57. Get Top-Rated Mortgage Offers Online.

Both FHA and Conventional home loans allow you to refinance your mortgage to get a lower mortgage payment and better interest rate. Though they can be harder to get a conventional loan can offer lower interest rates than an FHA loan which can translate to a lower monthly mortgage payment. FHA loan or conventional.

If you are below that score FHA will save you money. Which is a better loan. Conventional loans often offer higher loan limits than FHA loans.

As such FHA loans often feature enticing loan terms like flexible down payment options and relatively lenient eligibility requirements. Ad Are you considering an FHA loan for your next home purchase. While FHA loans are cheaper initially conventional loans are the cheapest option over the life of the loan.

See How Much You Can Save. Conventional loans require borrowers to pay for mortgage insurance if their down payment is less than 20. Conventional loans offer more flexibility in terms of your property.

Those with credit scores between 500 and 579 might qualify for an FHA loan if they can. Ad Get Pre-qualified for an FHA loan - Bad Credit OK. But borrowers can use multiple FHA loans for purchasing or refinancing a home loan.

Some borrowers are better off pursuing an FHA loan while others might find a conventional mortgage loan the better option.

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Fha Vs Conventional Loans How To Choose Updated For 2018 Total Mortgage Blog Buying First Home Real Estate Investing Rental Property First Home Buyer

Difference In Fha Vs Conventional Mortgage Loans In Kentucky Fha Loans Conventional Loan Mortgage Loan Originator

0 Comments